XRP Price Prediction 2025-2040: Analyzing the Path to $5.5 and Beyond

#XRP

- Technical analysis shows XRP consolidating in a symmetrical triangle pattern with critical support at $2.06

- Multiple ETF launches and institutional products creating new demand channels for XRP exposure

- Long-term price trajectory depends on utility development beyond current speculation-driven trading

XRP Price Prediction

XRP Technical Analysis: Key Support Holds Amid Consolidation Phase

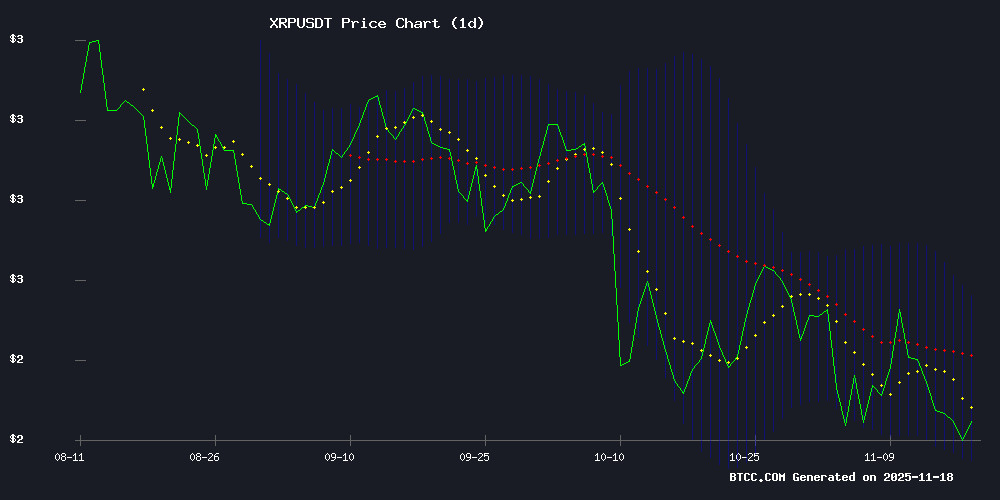

XRP is currently trading at $2.2156, below its 20-day moving average of $2.3362, indicating short-term bearish pressure. The MACD reading of -0.0081 shows weakening momentum, though the price remains above the critical Bollinger Band support at $2.1074. According to BTCC financial analyst Sophia, 'The current technical setup suggests XRP is consolidating within a symmetrical triangle pattern. Holding above the $2.06 support level is crucial for maintaining bullish structure. A break above the 20-day MA could trigger momentum toward the upper Bollinger Band at $2.5650.'

Mixed Market Sentiment as XRP Faces Fundamental Crossroads

Market sentiment for XRP reflects both Optimism and caution. Positive developments include Franklin Templeton and Bitwise launching XRP ETFs, with analysts predicting substantial day-one volumes. The Amplify XRP-linked income fund targeting 36% yield adds institutional credibility. However, BTCC financial analyst Sophia notes, 'While ETF launches and staking proposals provide bullish catalysts, the drop in XRP supply in profit to 58.5% signals underlying market stress. The key will be whether real utility develops beyond price speculation.' Technical analysts observe the symmetrical triangle formation could lead to a breakout toward $5.5 if bullish momentum sustains.

Factors Influencing XRP's Price

Ripple Executives Spark Debate on XRP Ledger's Future with Native Staking Proposal

Ripple's leadership has ignited a fresh discussion about the evolution of the XRP Ledger (XRPL), with engineering head J. Ayo Akinyele and CTO David Schwartz exploring how native staking could reshape value flows. This comes as XRP's utility expands beyond payments into tokenized asset settlement and institutional products like Canary's new XRP spot ETF.

The XRPL's unique fee-burning mechanism presents design challenges for staking rewards, requiring innovative incentive structures. Akinyele emphasized how programmability advancements could enable new participation models, noting that validator voting power currently operates differently than proof-of-stake networks.

Market observers see this as a pivotal moment for XRP's ecosystem maturation. The cryptocurrency's growing institutional adoption contrasts with technical debates about maintaining XRPL's lean efficiency while adding features demanded by decentralized finance applications.

XRP Supply in Profit Drops to 58.5%, Signaling Potential Market Stress

Glassnode data reveals a concerning trend for XRP holders. Only 58.5% of the supply remains in profit—the lowest level since November 2024. This marks a significant deterioration from previous months, with 41.5% of coins now held at a loss despite XRP trading four times above its $0.53 baseline.

Approximately 26.5 billion XRP were acquired during market peaks, leaving investors underwater at current prices. The concentration of purchases near all-time highs suggests fragile market structure. Historically, such conditions precede increased selling pressure as holders seek to minimize losses.

While the $2.15 price point appears strong relative to multi-year lows, Glassnode's metrics indicate underlying weakness. The data paints a picture of late-cycle entrants now bearing the brunt of market corrections—a pattern observed across crypto assets during periods of consolidation.

Amplify ETFs Launches First XRP-Linked Income Fund Targeting 36% Annualized Yield

Amplify ETFs has broken new ground in the crypto-linked investment space with the launch of XRPM, the first XRP-based income-focused exchange-traded fund. The innovative product aims to deliver monthly distributions through an active options strategy while maintaining exposure to XRP's price movements.

The fund's dual-pronged approach allocates 30-60% of its portfolio to covered calls, generating premium income through weekly out-of-the-money options. The remaining assets maintain long positions, allowing investors to participate in XRP's potential upside. Amplify projects the strategy could yield 3% monthly - translating to 36% annualized - from option premiums alone.

XRPM expands Amplify's YieldSmart ETF suite, marking a significant institutionalization of cryptocurrency income strategies. The fund's structure reflects growing demand for crypto exposure with reduced volatility, particularly among income-focused investors navigating the digital asset landscape.

XRP Holds Key Support at $2.06, Signaling Potential Recovery

XRP has demonstrated resilience amid broader market declines, rebounding from a weekly low of $2.10 to trade at $2.19. The cryptocurrency's ability to maintain support above $2.06 suggests a potential foundation for upward movement.

Technical analyst DrBullZeus identifies $2.06 as a critical demand zone, noting its successful test on November 4. A potential double-bottom formation could emerge if the support holds during future retests. The immediate resistance levels stand at $2.30, with subsequent hurdles at $2.45 and $2.69.

Market participants are watching the $2.06 level closely—a breach could signal further downside, while sustained support may catalyze gains of 11.8% to 22.8%. The current price action occurs against a backdrop of general cryptocurrency market weakness, making XRP's relative stability noteworthy.

XRP at Crossroads: Analyst Favor Upside Break Toward $5.5 Amid Symmetrical Triangle Formation

XRP's price action has reached a critical juncture within a symmetrical triangle pattern, with market analyst EGRAG highlighting a higher probability of bullish resolution. The digital asset, currently navigating recovery efforts from broader market turbulence, faces either a retreat to $1.02 or a rally toward $5.50.

Technical structure suggests accumulating momentum for an upward breakout, according to the analysis. Such a move would align with XRP's historical volatility cycles and renewed institutional interest in altcoins. The symmetrical triangle—often a continuation pattern—implies that the prevailing trend direction prior to its formation may reassert itself.

Franklin Templeton, Bitwise Lead Wave of XRP ETF Launches

Four spot XRP exchange-traded funds are poised to debut this week, marking a significant milestone for institutional cryptocurrency adoption. Franklin Templeton's EZRP begins trading today on CBOE, while Bitwise anticipates launching its offering by November 20 following SEC approval.

The flurry of ETF activity follows REX/Osprey's successful September launch of its XRPR fund, which has already attracted $150 million in assets. 21Shares and CoinShares have entered the SEC review pipeline, with late-November launches expected.

Market observers anticipate substantial capital inflows as these regulated products provide traditional investors with exposure to XRP. The developments build on growing momentum for the digital asset, which has seen renewed interest following recent regulatory clarity.

XRP Price Could Surge: Two Scenarios as Spot ETFs Impact Market

Chad Steingraber, a prominent XRP commentator, presents two divergent price trajectories for XRP amid spot ETF adoption. The first scenario envisions stable prices allowing gradual ETF accumulation of circulating supply, potentially triggering scarcity-driven rallies. Conversely, rapid price appreciation could slow institutional accumulation, creating upward pressure through reduced sell-side liquidity.

Fabio Marzella notes ETF inflows exhibit delayed market impact due to settlement cycles, suggesting price movements may lag behind fund flows. Steingraber maintains both outcomes ultimately benefit holders—whether through artificial scarcity or organic demand growth.

The analysis emerges as XRP underperforms relative to ETF-hyped assets, with Canary Capital's successful debut highlighting untapped institutional interest. Market dynamics now hinge on whether issuers methodically absorb supply or trigger reflexive buying through aggressive acquisitions.

Expert Says XRP’s Price Talk Means Little Without Real Utility

Fran De Olza, a former lawyer turned XRP-focused investor, emphasizes the token's long-term value lies in practical applications rather than short-term price speculation. "I'm more interested in what XRP will solve rather than guessing numbers or dates," he says, pointing to emerging digital economies like micropayments, AI systems, and metaverse ecosystems as key growth drivers.

XRP's transaction speed and scalability position it as a potential backbone for these markets, though Fran acknowledges the future will likely accommodate multiple networks. The recent launch of Canary Capital's Spot XRP ETF signals growing institutional interest, with retail investors holding just 2% of XRP's supply. Canary's CEO projects $5 billion to $10 billion in inflows, underscoring the market's untapped potential.

Franklin Templeton’s XRP ETF Could Hit $150–$250M Day-One Volume, Analyst Says

Franklin Templeton is poised to make waves in the crypto market with the launch of its spot XRP ETF, EZRP. Analyst Chad Steingraber predicts the fund could generate $150 million to $250 million in trading volume on its first day, potentially eclipsing the recent debut of Canary Capital’s XRPC ETF.

The XRP community is bracing for another milestone as institutional interest in the token gains momentum. Franklin Templeton’s entry signals growing confidence among legacy asset managers in digital assets, particularly XRP.

Expert Shares Simple XRP Game Plan: Details

As XRP shows signs of life, an expert trader has shared a simple yet elaborate game plan for its subsequent price development. Analyst DrBullZeus outlined the strategy in a recent update, coinciding with a broader market downtrend.

The cryptocurrency, long overshadowed by Bitcoin and Ethereum, is gaining renewed attention as traders seek opportunities in altcoins. Market participants are closely watching XRP's technical levels for potential breakout signals.

MoonPay Offers $2,025 in XRP for Price Breakout Challenge

Crypto payment provider MoonPay has ignited enthusiasm within the XRP community with a bold incentive tied to the digital asset's performance. The company announced a promotional giveaway contingent on XRP achieving a new all-time high by December 31, 2025.

One randomly selected participant will receive $2,025 worth of XRP if the cryptocurrency surpasses its historical price peak. The challenge reflects growing institutional engagement with digital assets while creating measurable excitement around XRP's market potential.

XRP Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical patterns and fundamental developments, XRP's price trajectory appears poised for significant movement. According to BTCC financial analyst Sophia, 'The symmetrical triangle formation and upcoming ETF launches create a compelling setup for medium-term appreciation.'

| Year | Conservative Target | Moderate Target | Bullish Target | Key Drivers |

|---|---|---|---|---|

| 2025 | $2.80-$3.20 | $3.50-$4.00 | $4.50-$5.50 | ETF adoption, triangle breakout |

| 2030 | $8-$12 | $15-$25 | $30-$45 | Mainstream adoption, utility growth |

| 2035 | $25-$40 | $50-$80 | $100-$150 | Global payment integration |

| 2040 | $60-$100 | $120-$200 | $250-$400 | Mature ecosystem, regulatory clarity |

These projections assume successful execution of Ripple's roadmap and broader cryptocurrency market growth. The near-term $5.5 target depends on breaking above current resistance levels with volume confirmation.